Pick Trust: Secure Trust Foundations for Your Building And Construction Undertakings

Pick Trust: Secure Trust Foundations for Your Building And Construction Undertakings

Blog Article

Securing Your Assets: Depend On Foundation Expertise within your reaches

In today's complex financial landscape, guaranteeing the safety and development of your possessions is extremely important. Trust fund structures offer as a keystone for guarding your wide range and heritage, giving an organized strategy to property defense.

Relevance of Trust Fund Structures

Trust fund structures play a vital function in establishing trustworthiness and promoting strong relationships in various specialist setups. Structure count on is important for companies to thrive, as it forms the basis of effective partnerships and partnerships. When trust exists, people feel more certain in their communications, causing enhanced productivity and performance. Depend on foundations function as the foundation for moral decision-making and transparent interaction within organizations. By focusing on depend on, companies can create a favorable work society where workers really feel valued and appreciated.

Benefits of Specialist Advice

Building on the foundation of trust fund in expert partnerships, looking for expert assistance provides indispensable benefits for individuals and organizations alike. Expert advice gives a wide range of understanding and experience that can assist navigate complex economic, lawful, or calculated difficulties easily. By leveraging the competence of experts in different fields, people and organizations can make informed choices that straighten with their goals and aspirations.

One substantial advantage of professional guidance is the capacity to gain access to specialized understanding that may not be conveniently available otherwise. Specialists can provide insights and viewpoints that can result in innovative options and chances for growth. Additionally, functioning with experts can aid reduce risks and unpredictabilities by offering a clear roadmap for success.

In addition, professional guidance can conserve time and sources by enhancing processes and preventing costly errors. trust foundations. Professionals can use personalized recommendations tailored to particular demands, guaranteeing that every choice is well-informed and calculated. Overall, the benefits of specialist guidance are diverse, making it a beneficial asset in securing and taking full advantage of properties for the long-term

Ensuring Financial Safety

In the world of financial planning, protecting a steady and thriving future depend upon critical decision-making and sensible financial investment choices. Ensuring financial safety and security includes a diverse technique that includes different elements of riches administration. One vital component is developing a varied financial investment profile tailored to private risk tolerance and financial goals. By spreading out investments throughout various property classes, such as supplies, bonds, genuine estate, and products, the risk of considerable financial loss can be mitigated.

In addition, preserving an emergency fund is vital to guard try this out versus unexpected expenditures or earnings disruptions. Specialists suggest setting apart three to 6 months' worth of living expenditures in a liquid, easily obtainable account. This fund serves as an economic safeguard, supplying satisfaction throughout rough times.

Regularly examining and adjusting monetary plans in action to changing scenarios is also extremely important. Life events, market variations, and legislative modifications can influence monetary security, underscoring the value of ongoing assessment and adjustment in the pursuit of long-lasting economic safety and security - trust foundations. By carrying out these strategies thoughtfully and continually, individuals can fortify their go right here monetary ground and work towards a much more safe and secure future

Safeguarding Your Possessions Properly

With a solid foundation in location for economic security through diversification and reserve upkeep, the following critical step is securing your properties properly. Safeguarding assets includes securing your riches from possible threats such as market volatility, financial downturns, lawsuits, and unexpected costs. One efficient method is possession allowance, which entails spreading your financial investments throughout different possession courses to minimize danger. Expanding your portfolio can assist reduce losses in one area by balancing it with gains in another.

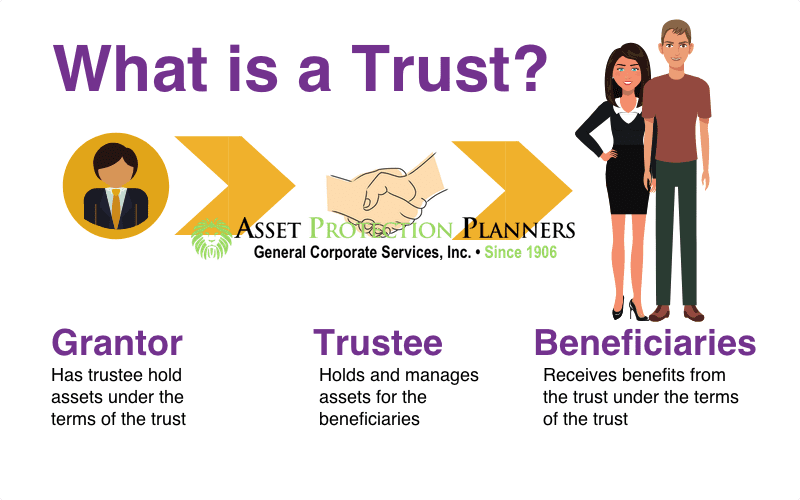

Additionally, developing a trust can use a protected means to safeguard your properties for future generations. Counts on can aid you control just how your assets are dispersed, decrease inheritance tax, and try here shield your wealth from financial institutions. By implementing these methods and seeking professional recommendations, you can safeguard your possessions properly and secure your monetary future.

Long-Term Property Protection

To guarantee the long-term security of your riches versus possible risks and unpredictabilities in time, critical preparation for lasting possession defense is vital. Long-lasting possession defense involves applying procedures to safeguard your possessions from various hazards such as financial downturns, suits, or unforeseen life occasions. One vital facet of long-term asset protection is establishing a count on, which can provide considerable advantages in protecting your properties from creditors and legal disputes. By transferring ownership of assets to a trust, you can protect them from potential risks while still retaining some level of control over their management and circulation.

Furthermore, expanding your investment profile is another vital technique for lasting asset security. By taking an aggressive approach to long-lasting property protection, you can secure your wide range and provide monetary protection for yourself and future generations.

Final Thought

To conclude, count on structures play an essential function in guarding assets and guaranteeing monetary protection. Expert assistance in establishing and handling trust fund frameworks is essential for long-term possession security. By making use of the knowledge of experts in this area, people can properly guard their assets and prepare for the future with confidence. Count on foundations offer a solid framework for safeguarding riches and passing it on to future generations.

Report this page